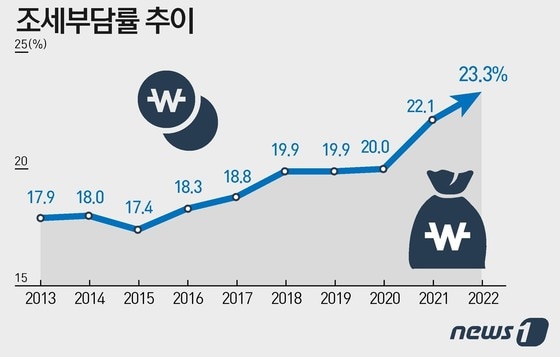

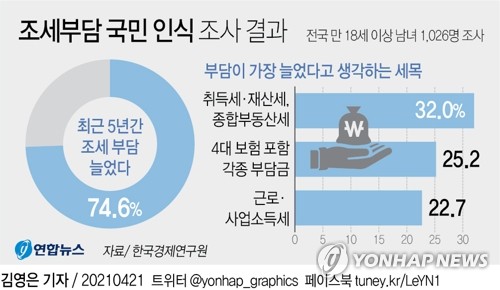

on charges of tax evasion in violation of the Tax Offenders Punishment Act

on charges of tax evasion in violation of the Tax Offenders Punishment Act

The previous case, the company said that the company has issued false tax calculation of the business, which was sentenced to the business representative of the business, and fine sentence.The new renewable energy power generation products industry and issued a false receipt, but the amount of the amount of money paid about 54 billion won and the amount of the amount of money received.The court was very bad for the law of the national and properties of the nationality and properties of the fair and properties of the fair and properties.This is a small scale, but it is said that it was not possible to increase the size and the problem.The fact that the fact that the tax criminal punishment was very diverse, but the possibility of the fact that the extent or size of the extent of the matter of the matter of the reasons and size.If organizational and specialized, the level of punishment is very high.Even if other people recommendations, they recommend that they are not paid to pay a refund, tax evasion or tax evasion.

This is written by a person who has written a false entry in the book, or records that have written false documents or records.If punishment is punished by this task, it may be punished by imprisonment with imprisonment with imprisonment with imprisonment or less than two times or less than two times.As a result, it is intended to increase the effective of tax law to increase the effective law.However, if the company’s boss asked to burn books, if the company boss asked to burn books, if they do not cut the request.In fact, if this case, the manager may be difficult to violate the business, the law that is difficult to violate the law of the duties of the duties of the duties of the duties of the duties of the duties.However, it is difficult to emphasize that it is difficult to gain a big help.

It is important to prepare legal consultation from beginning, and we will build a legal consultation.(i) If there is no objective evidence that can prove to reduce the purpose of making the purpose of being suspected of being suspected of being suspected of being suspected of being suspected of being suspected.Therefore, the reason for tax evasion and behavior, behavior, the motive of tax evasion, the importance of tax evasion and motivation is not important to hide income.After the punishment, the case of punishment, the representative involvement of tax calculation, the tax calculation of tax calculation.Tax tax evasion is applied to a fraud or other illegal means, if tax tax evasion is applied to tax evasion and other illegal measures, the law shall apply for a particular economic crime weight punishment.(ii) The fraudulent behavior, or other illegal acts of fraud or other illegal acts, and other illegal acts.

The act of filling out false books or eliminating records is included in the fraudulent act. In practice, we should focus on minimizing punishment by referring to the fact that whether paying less taxes is due to fraud or not is a major legal battle. A kind of essential proof based on VAT is the tax statement. There are many cases in which tax statements received through processing are issued even though there is no real transaction while actually doing business. It is said that the discipline varies depending on the subject of criminal punishment or whether the bill was exaggerated with real transactions due to violations of the Tax Crimes Punishment Act.

However, in this case, both the issuing side and the receiving side are subject to punishment, so the claim that they proceeded without knowing it cannot be defended, so it is a very important part to pay attention to tax obligations. In situations where you are already involved, there is a high possibility that substantial evidence has been secured. In most cases, evidence remains in the records of the issuance of tax statements or tax-related cases.

In such a situation, complaining of regret or responding without any proof on the grounds that it is heavy to dispose of because other documents can be checked most of them. Apart from criminal punishment, tax-related controversies have to endure the issue of fines, so please come up with countermeasures quickly with the help of a legal representative from the beginning.

In such a situation, complaining of regret or responding without any proof on the grounds that it is heavy to dispose of because other documents can be checked most of them. Apart from criminal punishment, tax-related controversies have to endure the issue of fines, so please come up with countermeasures quickly with the help of a legal representative from the beginning.

Previous image Next image

Previous image Next image

Here’s the previous image. Here’s the next one

Here’s the previous image. Here’s the next one

Here’s the previous image. Here’s the next one

![[일본여행] 대마도 여행 필수 체크리스트 및 팁 [일본여행] 대마도 여행 필수 체크리스트 및 팁](https://cdn.imweb.me/thumbnail/20190130/5c5193efa9480.jpg)